Position:Professor

email:stk25616a(at) ae.keio.ac.jp

Home Page:

https://lab.ae.keio.ac.jp/~imai_lab/

Financial Engineering, Computational Finance, Real Options

Our research field is Financial Engineering, which includes research in finance using applied mathematics and statistics. A numerical approach is often valuable for many researchers and practitioners to quantitatively evaluate the value of financial instruments and business because predicting the future perfectly is virtually impossible.

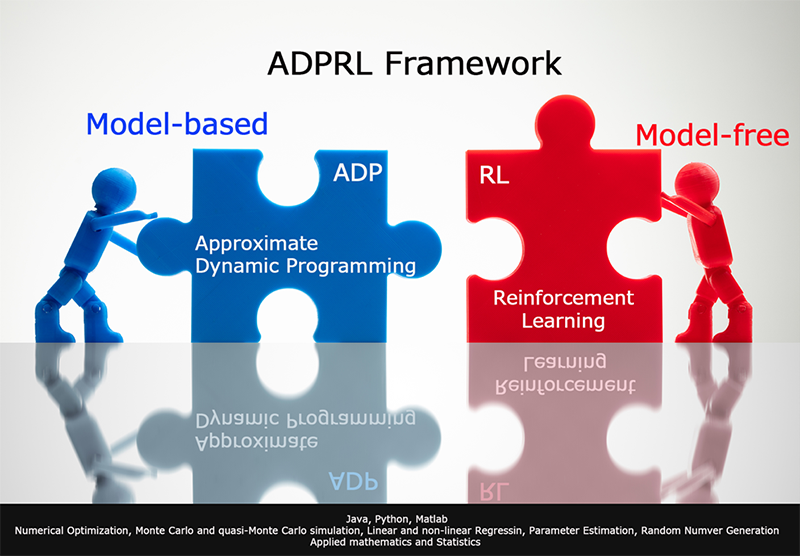

In this laboratory, we have been developing a new and more efficient numerical framework using Monte Carlo (MC) and quasi-Monte Carlo (QMC) methods and approximate dynamic programming and reinforcement learning (ADPRL) that are initially used in pricing derivative securities.

We have also been studying corporate finance, especially real options to understand better strategic decision-making under uncertainty.

Financial Engineering, Real Options, Corporate Finance

ADPRL is a numerical framework developed to derive the dynamically optimal solution in the presence of risk, ambiguity, competition, information asymmetry, and other important factors we face in reality. It can include many ideas and mathematical methods. For example, the approximate dynamic programming technique can be used to construct underlying stochastic processes explicitly, whereas the reinforcement learning approach is valuable when the underlying model is not explicit. In particular, let us emphasize that our laboratory has a deep experience in dealing with MC and QMC methods to enhance the simulation’s accuracy.

This framework can be used in

・pricing financial instruments, particularly exotic derivatives.

・estimating risk measures, such as value-at-risk and expected-shortfall (CVaR)

・modeling sophisticated stochastic processes, such as the Levy process and stochastic volatility model

The real option approach helps corporate managers make optimal decisions under risk. In our laboratory, we have studied

・how to create valuable real and financial options under the new type of risk

・effects of real options under ambiguity or model uncertainty

・effects of real options under competition

・how to apply real options in practice

Moreover, we have conducted both theoretical and practical research projects.

All the members of our laboratory choose their own research projects. Our goal is to assist the members in continuously making high level of intellectual contributions on the international stage.