Position:Professor

email:hibiki@ae.keio.ac.jp

Home Page:

https://lab.ae.keio.ac.jp/~hibiki_lab/

Financial Engineering, Asset Management, Risk Management, Portfolio Optimization, Financial Planning

We develop the theory and methodology for financial technology and its applications for the practical use. Specifically, we focus on (1) optimal portfolio selection for asset management, (2) statistical analysis for tick-by-tick stock data and optimal execution strategies, (3) household financial planning, and (4) risk management for financial institutions.

Financial Engineering 1, Quantitative Analysis and Business Decision, Advanced Financial Engineering 2

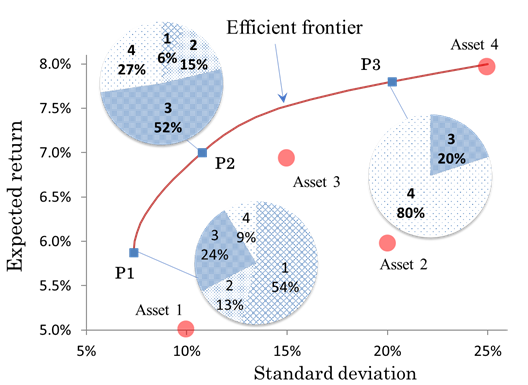

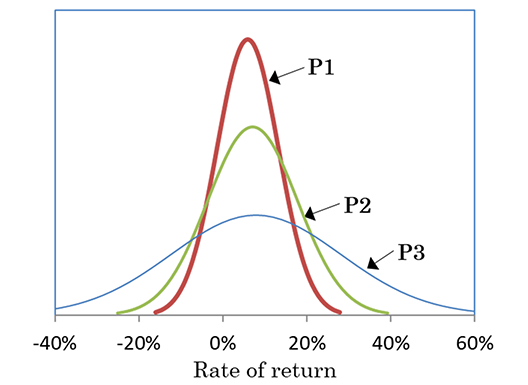

We must develop financial technologies for efficient asset management that considers risk and return and determine investment strategies to manage pension funds or design investment trusts. Specifically, we develop portfolio optimization models and estimation methods of return distribution. Additionally, we are practicing these research achievements through a joint research project with an asset management company.

Figure 1-1:Optimal portfolios

Figure 1-2:Return distributions

Institutional investors, such as life insurance companies and pension funds, attempt to execute orders at lower costs when buying and selling large amounts of stock. We develop a method for obtaining the optimal execution strategy in the multi-period optimization approach. Additionally, we analyze huge amounts of transaction data (tick data) representing the price and order volume for each transaction and estimate the parameters to solve the optimization problem.

Households must have financial plans for home purchasing, children’s education, and retirement, while being exposed to various risks. Therefore, research in “household finance” is becoming more important. We develop the optimal life planning model for long-term investment and insurance strategies so that our clients can spend a happy retirement life. We also developed the optimal retirement planning model for investment, pension, and consumption strategies after retirement. Furthermore, we analyze panel data related to household surveys so that it can be applied for modeling and actual financial advice.

Banks must implement sophisticated risk management. We build an integrated risk management model focusing on the characteristics of bank accounts, such as amounts of core deposits, interest rates, and the dependency structure between interest rate and default. Then, we analyze the Monte Carlo simulation approach. Additionally, we study the asset and liability management (ALM), an integrated risk management method for insurance companies, pension funds, and banks.

The goal is for students to acquire modeling techniques, quantitative methods, and analytical skills to solve financial problems and apply them in actual financial practice. Specifically, we would like our students to determine the research topics by themselves, enjoy the processes of quantitative modeling, analysis, and consideration, and finish writing their thesis. Additionally, we expect the master’s students to share their research achievements through, for example, presentation in domestic/international conferences and acceptance of their peer-reviewed paper for publication. We train our students to explain using not only mathematical formulas but also figures and words, especially to individuals in the financial industry who are struggling with mathematics.