Position:Professor

email:rei.yamamoto(at)ae.keio.ac.jp

Home Page:

https://lab.ae.keio.ac.jp/yamamoto_lab/

Financial Engineering, Asset Management, Portfolio Optimization

We develop models and conduct empirical analyses of asset management by pension funds, financial institutions, and individual investors, using financial data. An empirical analysis on the relationship between corporate behavior (e.g., information disclosure) and corporate performance is also conducted.

Financial Data Analysis, Entrepreneurship

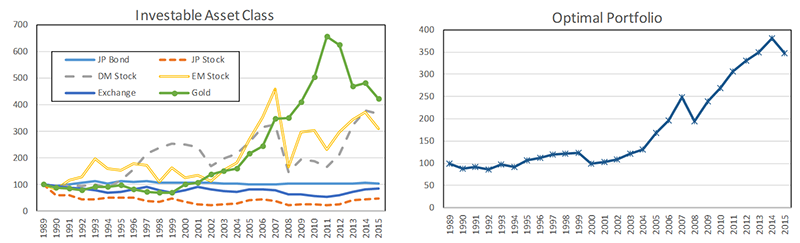

When institutional investors manage their funds using thousands of stocks, they estimate those stocks’ risks and returns and determine the optimal investments. This process requires technology to handle large amounts of data in the analysis of stocks and companies and to construct investment plans (portfolios) with optimal return and risk characteristics. We conduct research on state-of-the-art asset management methods, considering the recent trends in the asset management business.

When banks lend money to companies, they need to determine the tendency for those companies to go bankrupt. Financial institutions construct credit risk estimation models using quantitative methods that deal with huge amounts of data. Our laboratory conducts research on credit risk estimation methods adapted to various needs of financial institutions.

Companies conduct many activities other than business. For example, they disclose various information to investors, including the current statuses and future goals of their business as well as the steps they are taking to achieve those goals. We examine the relationships between the characteristics of companies that actively disclose such information and future performance by analyzing their corporate activities in detail.

Financial engineering is a research field wherein the real stock market and corporate behavior are analyzed using an engineering approach. To understand financial engineering, we must not only learn theories and knowledge but also possess programming skills to handle large amounts of corporate data. Moreover, the ability to interpret the results of data analysis concerning actual business/market environment is essential. The goal of our laboratory is to train students to acquire such abilities and become immediately effective in financial institutions.